SPOILER ALERT!

The Crucial Overview To Choosing The Right Insurance Company For Your Demands

Content writer-Clemensen Stern

Many individuals concentrate entirely on price or read on the internet evaluations when choosing an insurance provider. Nonetheless, there are https://blogfreely.net/torri62barbar/5-vital-skills-every-insurance-coverage-agent-ought-to-master to take into consideration.

For example, if you are buying from a broker, check out their customer contentment positions or ratings from agencies like AM Best. These scores can offer you a good sense of monetary toughness, claims-paying background as well as other elements.

Selecting insurance coverage is not only regarding cost, but also concerning making sure the coverage you pick suffices to safeguard your monetary future. Therefore, you must thoroughly stabilize cost with insurance coverage, as well as it is important to assess exactly how your decisions will certainly impact your lasting financial objectives and also requirements. If you are tempted to read on the internet reviews, think about discussing them with a company representative, as they may have the ability to provide comments that is useful in figuring out whether the evaluation is precise or not.

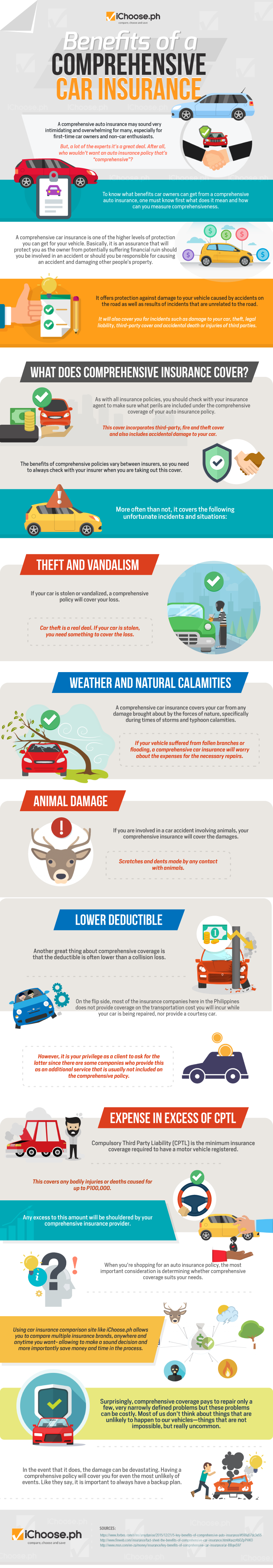

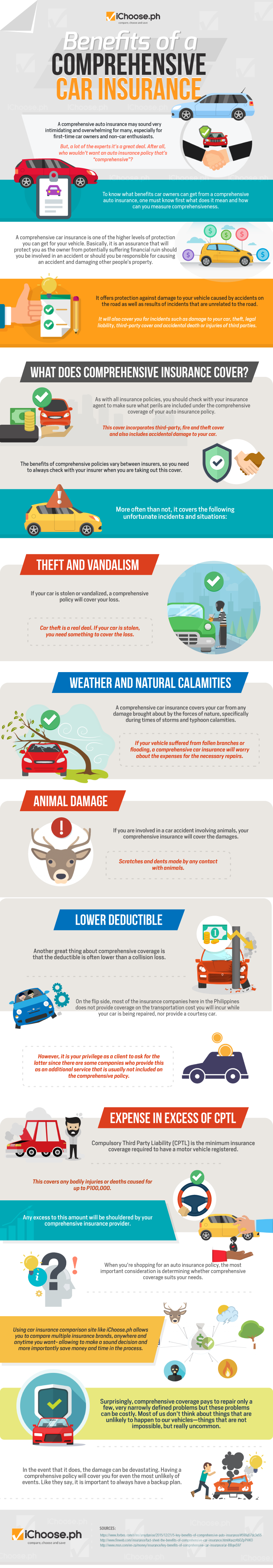

Insurance coverage is a method to swimming pool threat by paying for claims. It's a gigantic nest egg that pays for calamities we can't manage, like hurricanes, wildfires, typhoons, and also kitchen fires, and also day-to-day mishaps, such as minor car accident and also vehicle accidents.

Analyzing your insurance coverage needs as well as choosing proper coverage is a complex process. Considerations consist of price, coverage limits, deductibles, policy conditions, as well as the online reputation as well as economic stability of insurance policy service providers.

Take the time to contrast quotes from numerous insurers, taking into consideration discounts offered for packing policies or maintaining a tidy driving document. It's likewise important to assess the lasting implications of your coverage options. Examine exactly how they will safeguard your assets, revenue, and liked ones throughout the years. Ultimately, it's not practically price-- it has to do with protecting what matters most. This Ultimate Overview will certainly assist you choose the right insurance supplier for your distinct demands. https://writeablog.net/arthur612gudrun/the-role-of-modern-technology-in-changing-insurance-agent-practices will give you with peace of mind as well as protect your economic future.

Prior to an individual can begin selling insurance coverage, they need to get certified. This is a process that differs by state, yet generally includes completing pre-license education and learning courses and passing the state insurance policy test. It likewise needs sending finger prints as well as undergoing a history check.

The type of permit an individual needs depends on the kinds of insurance policy they prepare to market. There are normally two primary types of insurance policy licenses: home and also casualty, which concentrates on insurance policy for vehicles and residences, and life and health and wellness, which concentrates on covering individuals as well as families in case of a mishap or fatality.

Firms that use several lines of insurance coverage need to have a company permit, while private agents can acquire a specific permit for the lines they plan to offer. The licensing process is managed at the state level, however many states currently utilize 3rd parties to assist overview and carry out license applications in order to advertise effectiveness.

Many individuals concentrate entirely on price or read on the internet evaluations when choosing an insurance provider. Nonetheless, there are https://blogfreely.net/torri62barbar/5-vital-skills-every-insurance-coverage-agent-ought-to-master to take into consideration.

For example, if you are buying from a broker, check out their customer contentment positions or ratings from agencies like AM Best. These scores can offer you a good sense of monetary toughness, claims-paying background as well as other elements.

Price

Selecting insurance coverage is not only regarding cost, but also concerning making sure the coverage you pick suffices to safeguard your monetary future. Therefore, you must thoroughly stabilize cost with insurance coverage, as well as it is important to assess exactly how your decisions will certainly impact your lasting financial objectives and also requirements. If you are tempted to read on the internet reviews, think about discussing them with a company representative, as they may have the ability to provide comments that is useful in figuring out whether the evaluation is precise or not.

Coverage

Insurance coverage is a method to swimming pool threat by paying for claims. It's a gigantic nest egg that pays for calamities we can't manage, like hurricanes, wildfires, typhoons, and also kitchen fires, and also day-to-day mishaps, such as minor car accident and also vehicle accidents.

Analyzing your insurance coverage needs as well as choosing proper coverage is a complex process. Considerations consist of price, coverage limits, deductibles, policy conditions, as well as the online reputation as well as economic stability of insurance policy service providers.

Take the time to contrast quotes from numerous insurers, taking into consideration discounts offered for packing policies or maintaining a tidy driving document. It's likewise important to assess the lasting implications of your coverage options. Examine exactly how they will safeguard your assets, revenue, and liked ones throughout the years. Ultimately, it's not practically price-- it has to do with protecting what matters most. This Ultimate Overview will certainly assist you choose the right insurance supplier for your distinct demands. https://writeablog.net/arthur612gudrun/the-role-of-modern-technology-in-changing-insurance-agent-practices will give you with peace of mind as well as protect your economic future.

Licensing

Prior to an individual can begin selling insurance coverage, they need to get certified. This is a process that differs by state, yet generally includes completing pre-license education and learning courses and passing the state insurance policy test. It likewise needs sending finger prints as well as undergoing a history check.

The type of permit an individual needs depends on the kinds of insurance policy they prepare to market. There are normally two primary types of insurance policy licenses: home and also casualty, which concentrates on insurance policy for vehicles and residences, and life and health and wellness, which concentrates on covering individuals as well as families in case of a mishap or fatality.

Firms that use several lines of insurance coverage need to have a company permit, while private agents can acquire a specific permit for the lines they plan to offer. The licensing process is managed at the state level, however many states currently utilize 3rd parties to assist overview and carry out license applications in order to advertise effectiveness.